Let’s Talk About That “Independent Contractor” You’ve Got on Payroll

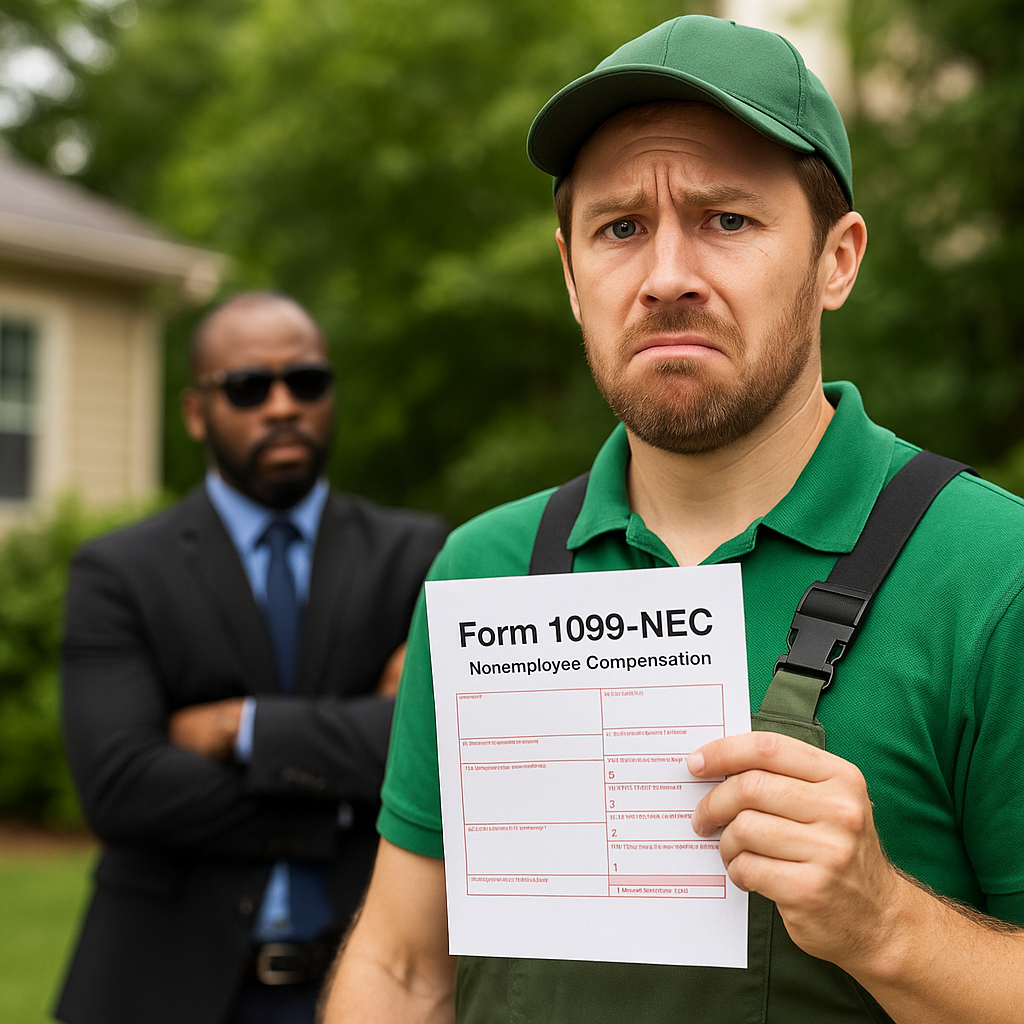

You’ve got a solid lawn care crew, maybe a few helpers you toss some cash or Zelle money to at the end of the week. You figure: “I pay ‘em on a 1099, so I’m good, right?”

Wrong.

If you’re treating someone like an employee but calling them a “contractor,” you might be one slip-and-fall away from an insurance nightmare. Let’s break it down before the IRS or Workers’ Comp board does it for you.

The Big Myth:

“If I pay them on a 1099, they’re a contractor, not my employee.”

Nice try — but that’s not how the IRS, insurance companies, or your state labor board sees it.

What Actually Determines Contractor vs. Employee?

It’s all about control.

Ask yourself:

- Do you tell them when and where to show up?

- Do they wear your shirts or drive your truck?

- Do they use your equipment?

- Are they working just for you?

- Do they not send invoices — just get paid “under the table” or via Cash App?

If you’re nodding “yes” to most of those… congratulations, that’s an employee in the eyes of the law.

Why This Is a Big Freakin’ Deal

- Workers’ Comp won’t cover injuries if you misclassify

- Auditors can retroactively charge you for unpaid premium

- You can be sued by the worker if they get hurt

- IRS penalties for tax evasion, misclassification, or both

- You’ll lose any “I thought they were a contractor” defense in about 3 seconds

One pulled muscle away from a claim Jimmy thought he didn’t need to cover.

Real-World Example:

Jimmy owns a landscaping business and puts three guys on 1099s. One of them tweaks his back while raking leaves and ends up needing medical treatment. He files a Workers’ Comp claim. The state investigates and reclassifies the worker as an employee.

Jimmy ends up with fines, back pay, and a Comp premium he wasn’t prepared for.

And that’s if he’s lucky.If the worker decides to lawyer up — Jimmy could be on the hook for medical bills, lost wages, and legal fees out of his own pocket. Workers’ Comp exists to protect against exactly this — but if you don’t have it and the guy should have been covered?

You’re the insurance company now.

What You Should Do

Talk to your insurance agent (yes, we mean us)

Get a proper Workers’ Comp policy

Require true subcontractors to carry their own coverage

Use legit contracts, invoices, and tax records

Don’t wing it — ask for help if you’re unsure

How Green Pro Helps:

We’ll:

- Walk through how you’re classifying workers

- Help you cover what needs covering — without overpaying

- Review your subs and make sure you’re not holding the liability bag

- Give you real advice, not “bro-science” from Facebook groups

Bottom Line

If it walks like an employee, talks like an employee, and mows like an employee… they’re probably not a contractor.

Play it smart. Your business is worth more than a few saved bucks on payroll taxes.