How One Lawn Pro Got Burned by a “Bargain” Policy — and What We Did About It

It’s a story we hear all the time at Green Pro Insurance.

A lawn care business owner wanted to do the right thing. He shopped online, compared quotes, and bought policies from big-name companies that get tossed around in Facebook groups every day.

He thought he was covered.

But the truth? He was underinsured, overpaying, and dangerously exposed.

Let’s break it down.

Auto Coverage: Big Price, Minimal Protection

What he had:

- 3 trucks, 3 drivers

- Liability: Bare minimum state limits – 25/50/25

- No Uninsured Motorist coverage

- Deductibles: $2,500 for comp & collision

- Annual cost: $10,909.00

He was paying premium dollars for basic protection — and still at risk if something serious happened on the road.

What we gave him:

- Liability: Increased to $250,000 Combined Single Limit

- Uninsured Motorist: Added at $100,000 CSL

- Medical Payments: $10,000 per occupant

- Deductibles: Dropped to just $500

- Annual cost: $3,431.00

Over $7,400 in annual savings

Way more coverage

Peace of mind that actually works when you need it

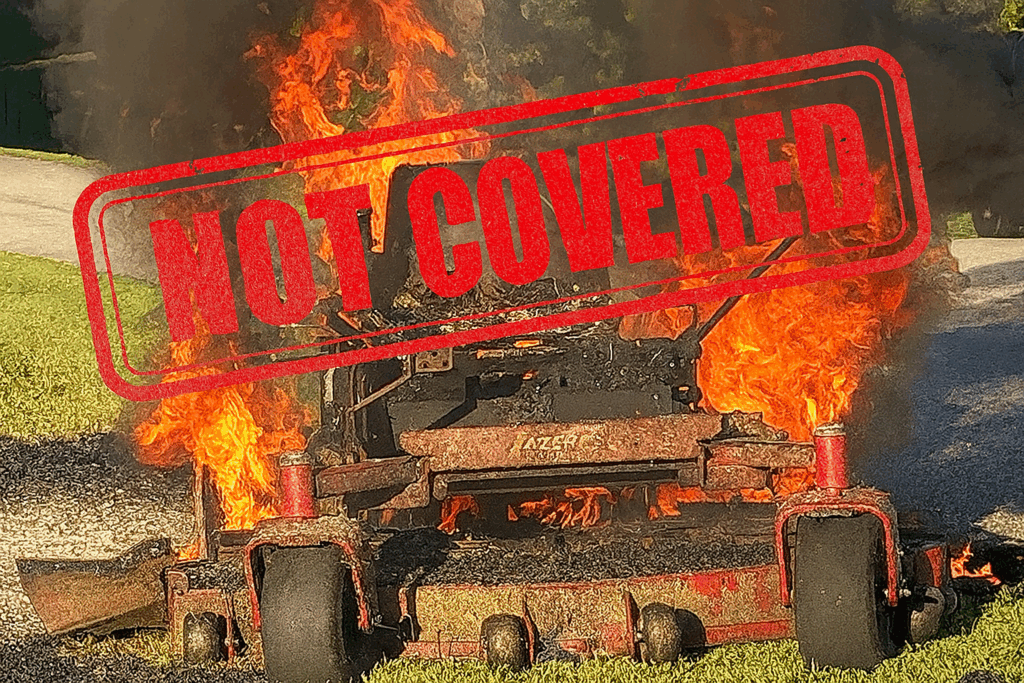

General Liability: Bare Bones, No Equipment Protection

What he had:

- $1,000,000 General Liability

- No coverage for tools or equipment

- No coverage for fertilizer or pesticide application

- Annual cost: $1,254.00

What we gave him:

- Maintained $1M Liability

- Added: Fertilizer & pesticide application coverage

- Included: $25,000 in scheduled equipment (mowers & skid sprayer)

- Annual cost: $784.00

Coverage tailored to the real risks of his business

Equipment finally protected

Nearly $500 saved annually

What He Told Us

“I honestly thought I was doing the right thing. I didn’t realize how much was missing until you walked me through it.”

We’re keeping his name private — because unfortunately, he’s not alone. This happens all the time.

The Bottom Line

Buying insurance on your own might feel smart.

But unless you know what to look for, you could end up like this customer — paying more for coverage that doesn’t actually cover you.

At Green Pro, we only insure green industry businesses. We know what coverage lawn and landscape pros really need — and how to keep the price fair.

Think You’re Covered?

Let’s find out for sure — before it’s too late.